It is the time of the year when analysts and others take their crystal balls out of the closet for the annual dusting off. A new year with unwritten pages beckons, with yet unknown challenges and opportunities. The year soon to be consigned to the history books is likely to be one best forgotten for many players in the tanker sector. Unlike dry bulk and container shipping, which both have enjoyed a year of significant earnings, the tanker sector has struggled to make any profits. However, next year has been widely seen as the return to black numbers for the beleaguered segment, with continued global economic recovery and production hikes from OPEC+ expected to fuel demand for seaborne transportation.

The tail end of the year has come up with several issues that have thrown the expected strength of next year’s recovery into question. It remains unclear to what extent the new Omicron variant of the coronavirus will disrupt the global economy, with analysts’ expectations covering the whole range from limited impact to extensive damage. The International Energy Agency (IEA) has recently said that it expects the rapid spread of the new variant to “temporarily slow, but not upend” the recovery in oil demand. The agency lowered its demand forecast for the first quarter by 600,000 barrels per day, as it expects the new restrictions in the wake of the resurgent pandemic to reinforce the seasonal weakness. However, the IEA anticipates that vaccine roll-outs will limit the long-term effects on oil demand and has, by contrast, only reduced its full-year forecast by 100,000 barrels per day.

On the other hand, OPEC’s analysts are considerably less concerned regarding the impact of the new virus variant and see demand growth during the early parts of next year in line with rates seen in the years prior to the pandemic. The organisation has recently upgraded its estimates for demand during the first quarter to 1.1 million barrels per day, as it expects some of this year’s recovery delayed by Omicron to shift into early next year.

Freight Markets

Crude - VLCC

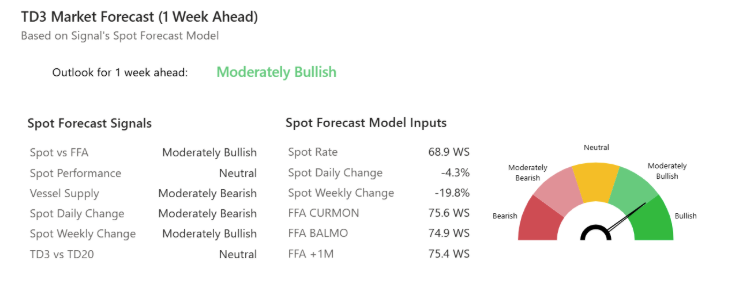

The late-year resurgence of the pandemic has dashed any hopes for the beleaguered owners of crude tankers of ending the year on a positive note. While a recovery during the latter part of December has brought VLCC rates above those recorded at the end of last year, the freight markets have failed to mirror the strength of the crude oil markets throughout the year. Despite a sizeable retreat, crude oil prices have gained around forty per cent year to date. The freight rates exhibited some positive momentum during the second half of the year, with a fifty per cent increase in WS rates between late August and the end of October. However, much of those gains have evaporated in recent weeks. The rapid spread of the Omicron amplified the effects of the release of crude oil from strategic reserves by the US and other countries and have dampened the demand for seaborne tanker transportation. The disparity between the performance of the oil and freight markets highlights that supply has been the main factor, with too much tonnage available at the same time as OPEC and other producers have constrained output.

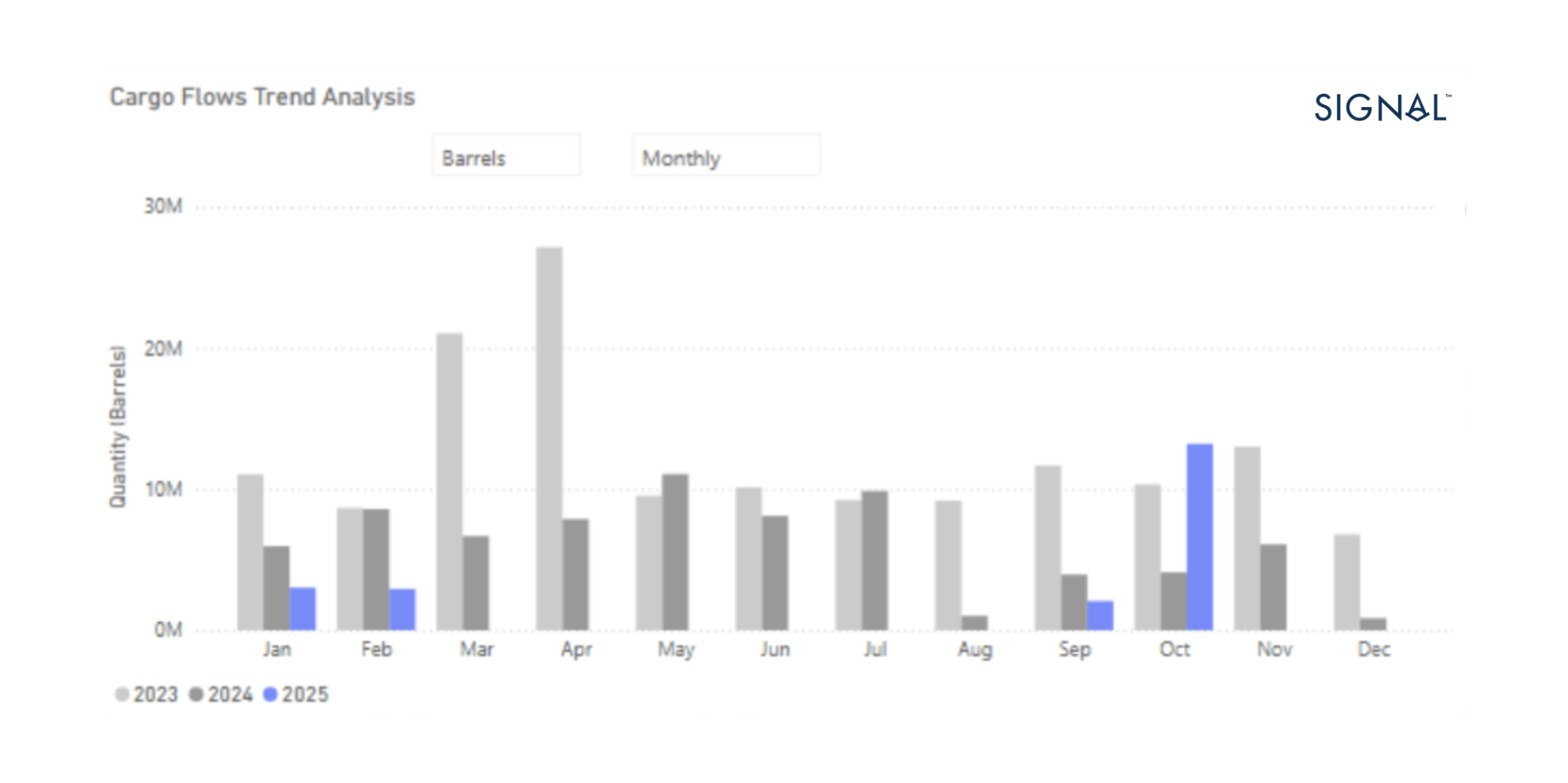

The energy crunch that befell China in the earlier parts of the quarter saw the headlines dominated by coal and natural gas as imports and prices surged. However, somewhat in the shadows, crude oil shipments to the world’s largest importer also increased as the country boosted its energy purchases. VLCC shipments to Chinese ports have risen by almost forty per cent since the middle of October and provided the freight markets with some much-needed support.

Crude Demand - VLCC shipments

Unless the Omicron variant, or yet another mutation, wreaks complete havoc on the global economic recovery and drives a sharp drop in oil demand, the dirty tanker market should improve in the coming year. Several factors should align to create an environment beneficial for improving charter rates. A continued recovery in oil demand paired with increasing output from OPEC+ should boost demand for tanker tonnage. The low oil inventories around the globe are also a bullish signal, as many refineries may be looking to restock following a long period of drawdowns during the pandemic. In addition, an increasing number of vessels have been sent for recycling during the last quarter, which will support rates. However, the recovery starts from a very low base, and any spectacular returns are likely to be confined to the paper market. For the physical market, the path to profitability can be expected to be lengthy and arduous. The current rapid spread of the Omicron variant is also likely to push the recovery further into next year.

Impact of Slow Steaming on Crude Rates

One factor that is unlikely to support rates in the coming year is slow-steaming. According to Signal’s data, the weekly average speeds in the crude trade have been trending lower for much of the year. While average speeds picked up during the first half of the fourth quarter, as demand and freight rates rebound, renewed concerns over the pandemic have seen vessels slowing down yet again. As a result, speeds are still below what was recorded a year ago and will offer only limited scope for additional slow-steaming should the demand remain weak.

Clean MR2

While the dirty tanker sector has had a challenging year, the freight market for tankers transporting refined petroleum products has eventually endured a less problematic year. Unlike their dirty siblings, clean tankers have enjoyed quite a revival during the last month. Freight rates for clean MR2 tankers on the Continent to US Atlantic Coast route have enjoyed the best rates since May 2020 in the recent days.

The release of strategic oil reserves harmed the tonnage demand in the dirty sector. Their proximity to the refineries reduced the need for seaborne transportation compared to the oil moving from overseas producers. On the other hand, the release did not alter the demand for refined products and, hence, the clean sector did well as global demand for fuel continued to recover. The number of laden MR2 vessels have been trending higher during the fourth quarter as the global economic recovery kept gaining momentum. Average vessel speeds in the clean taker trade have been volatile throughout the year but have risen recently, as the number of laden vessels increased during December.

The Tanker Market Recovery Drifting Further Into Next Year

However, the spike in activity and clean freight rates may prove to be short-lived if the pandemic fuelled by the Omicron variant proves to be tricky to control. With many countries starting to impose new travel restrictions and lockdowns, demand for refined products is likely to suffer and clean freight rates will head south yet again. If the new variant proves to be more contagious but less severe, as some analysts suggest, the negative impact on freight rates is likely to be temporary. However, until more data on the variant becomes available, most governments are likely to err on the side of caution to avoid overwhelming their health care services. Hence, the New Year may not bring much joy for the tanker owners, and the recovery, like most conferences, will be postponed yet again.

To generate the same insights for your business and learn more about The Signal Ocean platform, contact us here.

For the latest updates and insights, make sure to visit the Signal Ocean Newsroom website page.

-Republishing is allowed with active link to source.

Ready to get started and outrun your competition?

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.avif)

.avif)