Navigating ETS Compliance: Challenges and Strategies for the Shipping Industry

The recent COP26 event has again shone a light on the Shipping Industry’s need to accelerate its ambitions around decarbonisation. However, most of the discussions at the conference focused on the ‘bigger picture’ elements of Shipping’s decarbonisation, and details on exactly how Shipping will get to net zero were in limited supply. This is perhaps not surprising - ours is a mammoth challenge and our path to a greener future is currently uncertain. However, some elements of this path are certain - Shipping is set to be included within Europe’s Emissions Trade Scheme (ETS) from as soon as 2023, and it's still not clear exactly if vessel owners, commercial operators or both are going to have to comply.

Earlier this year the EC announced some short term measures that have some major potential to disrupt Shipping markets. Most significantly, this included Shipping’s involvement in the ETS from 2023 and ‘Fuel EU Maritime’ starting in 2025. This means that from 1st Jan 2023, for every MT of carbon emitted by a Shipping company it will need to retrospectively buy an allowance (EUA) from the EU to emit said MT of carbon. This will significantly impact the voyage costs of Shipping companies. The Signal Ocean Platform enables us to calculate some real world examples of Co2 emissions, and what the impact on a voyage could be:

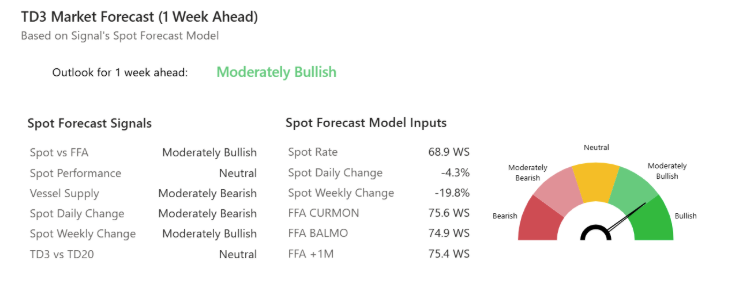

If we consider an Aframax voyage from the Baltics to the Adriatic for a model vessel in the Signal Ocean Platform the total costs of the voyage are as displayed in image 1 below. Specifically, the bunkers breakdown as follows:

The total cost of bunkers is approximately US$507,000 for this voyage. The platform has automatically calculated that the total Co2 emitted on the voyage would be 2,700 MTS. Today, it costs approximately US$70 per EUA. This means that the ETS compliance cost for this one specific voyage is US$189,000. This represents a 24% increase in voyage costs or a 37% increase in bunker costs.

One approach for a Shipping company could be to consider this and say “ I will just pass this new, additional cost down the chain to the charterer”. That is correct - market forces dictate that the end user will eventually have to pay a higher amount to receive their goods to cover the cost of decarbonising the supply chain. However, it is currently not clear if it will be the vessel owners or commercial operators that will be looking to pass the cost on to the charterers. Those of us in Shipping know that this is an important legal and financial distinction to make, but current EC legislation is ambiguous on this point. But why is this lack of clarity such a problem? To provide some context we need to wind back the clock and consider things from the EC perspective.

As a response to the Kyoto Protocol of 1997, the EU ETS started life in 2005. It focused on major industrial carbon producers in the EU - eg power utilities. Typically, power generation companies are large entities, they have fixed assets (the power generation plants themselves) and they have big balance sheets as a result of this. They are also geographically based and incorporated in Europe. For all these reasons they are obvious targets for EU ETS compliance. It is therefore logical that the EC would extend the mechanics of this scheme to capture other carbon producers that touch Europe.

However, this is a very delicate matter and ‘one size does not fit all’ in the case of the Shipping Industry. Shipping is a very different animal from the other major industrial sectors that have been pulled into the EU ETS already. Shipping is characterised by thousands of smaller legal entities (representing tens of thousands of floating carbon emitters), usually incorporated offshore, many of whom have very weak balance sheets. Also, because Shipping by its very nature is intercontinental, not all of it its emissions are within the European domain. Nevertheless, it must comply with the global decarbonisation agenda for obvious reasons, and in the absence of a global market based solution sponsored by the IMO, the EC has been left to forge its own path. For this reason, Shipping is being pushed into the ETS as a ‘least worst’ option. However, as part of this push, it is concerning to me that not a lot of thought has been given to exactly which type of Shipping companies will be required to comply.

In its recent directive focused on Shipping in the EU ETS, the EC attempts to identify exactly who is responsible for ETS compliance as follows:

The definition above seems to place some emphasis on the vessel owner being the entity that needs to comply. However, elements of this definition are vague and unhelpful. For example, vessel owners will already be familiar with the IMC, but they are often not the entity that is responsible for the choice of fuel, route and speed of the ship. Regularly these decisions are often made by the commercial operator of a vessel. If we follow the ‘polluter pays’ principle mentioned above, who is the real polluter here? Is it the company that owns the hull? Or is it the company that profits from operating the vessel and buys the fuel? The directive also appears to be giving the owner license to make the commercial operator responsible, but how can this work in practice without clear guidelines?

The definition also mentions the ‘global data collection system established in 2016’. This presumably refers to the IMO Data Collection System (DCS) which is a process that only vessel owning companies need to concern themselves with. It is not mentioned in the definition, but the EU also has its MRV (Monitoring, reporting and verification) system running in parallel with DCS, which is again the responsibility of the vessel owner. This is relevant because if the EU is already receiving emissions data directly from owners then it would be logical and practical for them to be targeted for compliance. But is this just? The owners could perhaps argue that they have incurred the cost and inconvenience of MRV compliance and therefore it is not fair that they are being targeted now for EU ETS compliance as a result. On the other hand, if the scheme was to target commercial operators only, they could argue that they are ignorant to the methodologies of EU environmental compliance, they don’t have the expertise or balance sheet to comply and most importantly they don’t own the asset.

The practicality of ETS compliance is an important theme that requires a great deal more thought. Currently, the ETS works as follows: Companies must monitor their carbon emissions for the calendar year, they then have three months at the beginning of the following year to submit a verified carbon emissions report to authorities and then one month to procure the required amount of allowances and surrender them to the local registry. For a power generation company this is relatively straightforward, they know long in advance what their emissions will be, and they have the balance sheet and expertise to manage the price risk of a ‘future’ requirement. In contrast, the vast majority of ‘Shipping Companies’ do not have the luxury of precisely knowing what their future emissions in Europe will be, they also do not have the balance sheets or expertise to manage the price risk of carbon. Typically, they are used to managing cashflows and price risks within their voyage costs by obtaining their bunkers on 30 days credit. This means that they can defer the largest cost (fuel) until after they receive their revenues (freight). Freight rates will in part fluctuate as a function of fuel costs so creating an imperfect hedge against price risk movements. If we add EU allowances into this cashflow mix things become more complicated - as shown in the Signal Ocean platform, EUA’s could have the effect of increasing voyage costs significantly, but because they run on a completely different time cycle (annual compliance) there is a great deal of room for error for those companies that need to comply.

This lack of clarity around the ‘who’ of compliance is leading to some interesting debate in ship owning circles. Danish shipowners appear to welcome the responsibility of ETS compliance, whilst other bodies feel that it is the commercial operators that need to comply. It seems that this debate will continue for quite some time in the absence of the IMO engaging in a meaningful way around the creation of a global market based measure to deal with carbon.

Outside of power generation, Shipping is not the only international transportation industry that has been targeted by the EU ETS. To varying degrees, Aviation has been included in the EU ETS since 2012, so is there anything we can learn from its route into European compliance? The answer is not straightforward, unfortunately. This is because Aviation’s governing body - the ICAO, has arguably done more than the IMO to provide global market based measures to place Aviation on a greener path. It launched its own, global emissions cap and trade scheme (CORSIA) in 2016 and whilst this arguably hasn’t significantly improved Aviation’s carbon credentials, it has enabled the Aviation Industry to significantly dilute its involvement in the ETS, so ours is not an ‘apples to apples’ comparison. Despite this, it has a long history of complying with EU ETS than Shipping, so I think we can take some cautious guidance from its experience.

In short, the EU ETS targets ‘Aircraft Operators’ operating within the European Economic Area (EEA). A good example of an Aircraft Operator would be a large international airline. However, an airline can own or lease the aircraft in its fleet meaning that today it is paying for EUA’s regardless of its relationship with the airframe carrying its banner. However, the EU ETS Directive states that for any flight that touches the EEA where the Aircraft Operator cannot be identified the responsibility for EU ETS compliance falls upon the owner of the aircraft. If we apply this model to Shipping today it means that the commercial operators would be the first in line for EU ETS compliance where the vessel owner is not operating the vessel itself, but the vessel owner would be ultimately responsible in the event of the commercial operator not paying for the EUA’s for any particular reason.

Despite the fact that Aviation has been involved in the EU ETS for almost a decade, it appears that the structure of its own market causes some administrative headaches and uncertainty today: A cursory glance at current EC guidance on Aviation in the EU ETS shows that it is dealing with questions including “Who is an aircraft operator?”, “Who is the operator under a ‘wet lease’ agreement?”, “Can a management company be an aircraft operator?” - no doubt structural parallels can be drawn to our own market (e.g. bareboat charters, time charters etc). What is more revealing though is that the EC publishes a long list of Aviation companies that have registered for EU ETS compliance purposes. The list includes both major aircraft owners and airlines - it, therefore, seems probable that the complexion of any ‘Shipping Company ETS List’ in 2023 will be broadly similar. We can therefore probably expect to see both vessel owners and commercial operators footing the bill for EU ETS compliance in the near future.

To discuss ETS compliance and learn more about The Signal Ocean platform, contact us here.

About the author:

Employed as Entrepreneur-in-Residence, Daniel Rose is a Marine Fuels Executive with over 20 years of experience in commodities and shipping. At The Signal Group we work with experienced and driven founders via our Entrepreneur-in-Residence program. Together we build transformative new ventures in maritime that we accelerate with access to our technology, data APIs, talent, capital and sector expertise.

For the latest updates and insights, make sure to visit the Signal Ocean Newsroom website page. Click here to request a demo.

-Republishing is allowed with active link to source

Ready to get started and outrun your competition?

.png)

.png)

.png)

.png)

.png)

.png)

.avif)

.avif)