India's energy landscape is undergoing a significant transformation as the nation seeks to balance economic growth with sustainability. While coal remains a dominant energy source, efforts to achieve market independence through increased domestic production and reduced imports are gaining momentum. Simultaneously, India is investing in renewable energy, green shipping initiatives, and infrastructure upgrades to transition toward a cleaner future. This market analysis explores India's evolving coal India market dynamics, energy diversification strategies, and policy initiatives aimed at fostering a sustainable energy ecosystem amidst rising concerns around climate change, geopolitics, and commodity trading disruptions.

Coal Market Trends

In 2024, India's coal production reached a record high, driven by increased demand from utilities and a government initiative to boost domestic output. Total coal production from state-controlled entities like Coal India Limited (CIL), Singareni Collieries Company Limited (SCCL), and privately allocated mines for industrial use amounted to 1.04 billion tons, marking a 7% increase from the previous year. This surge reflects India’s strategy to secure supply chains in a volatile global commodity environment.

CIL's production rose to 785.2 million tons in 2024, up from 756.1 million tons in 2023. In contrast, SCCL's output slightly decreased by 4% to 67.12 million tons. Notably, production from company-operated mines (captive blocks) designated for direct industrial consumption saw a significant rise, reaching approximately 187 million tons, up from 143.3 million tons the previous year.

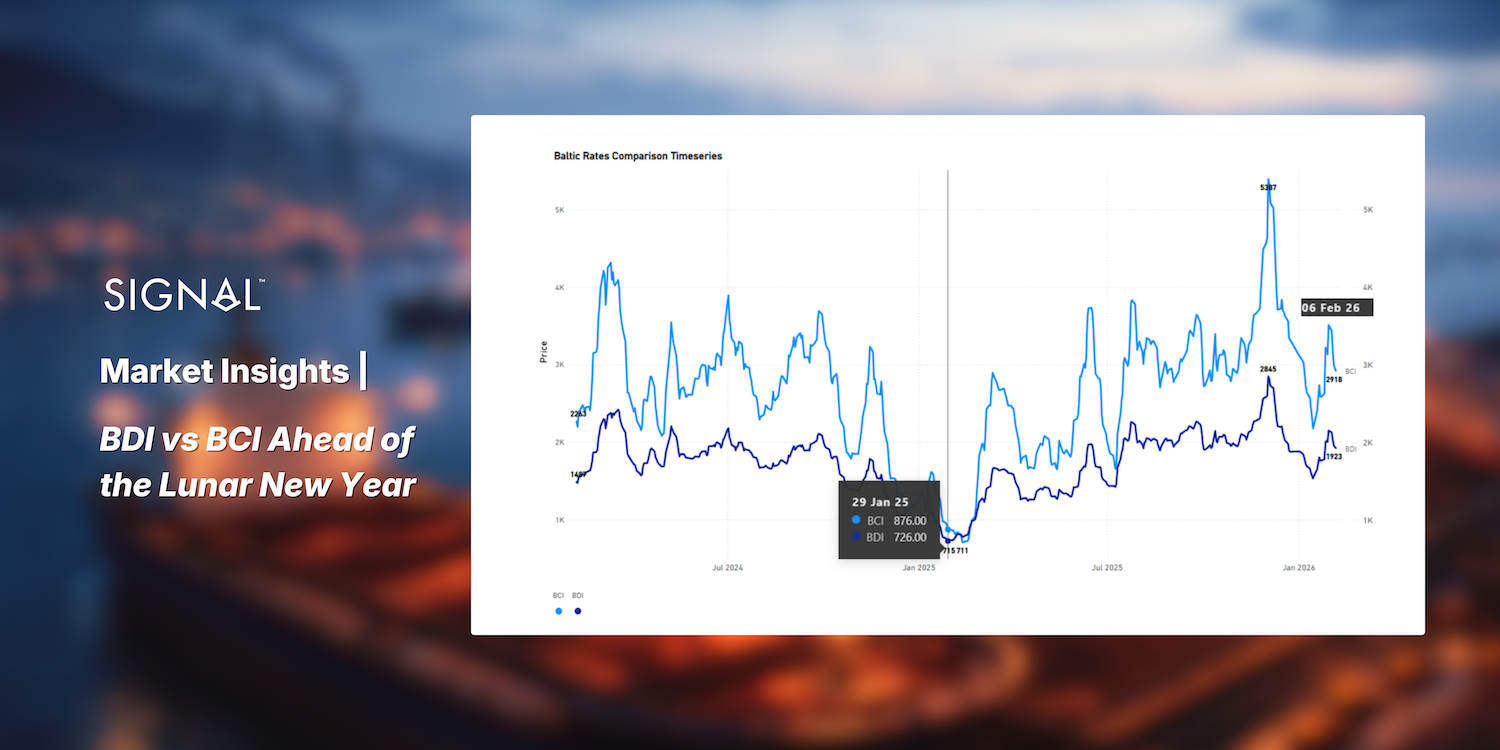

In 2024, India’s coal import trends revealed significant fluctuations compared to previous years, reflecting shifts in demand and domestic supply dynamics. Q1 imports surpassed those of 2022 and 2023, signaling increased reliance on international commodity sources to meet rising energy demand. While Q3 saw a sharp decline due to increased domestic output, Q4’s rebound underscores the flexibility required in navigating global commodity trading markets. Much of this cargo movement was facilitated by bulk vessels, reflecting the importance of maritime logistics in India’s energy trade.

Despite the mid-year downturn, Q4 saw a rebound, bucking the typical downward trend observed in prior years. These contrasting patterns underscore India’s evolving coal strategy, balancing increasing self-sufficiency with the continued need for flexibility in imports to meet fluctuating industrial and power sector demands. This has made vessel scheduling and freight rate forecasting more complex in an already volatile maritime market.

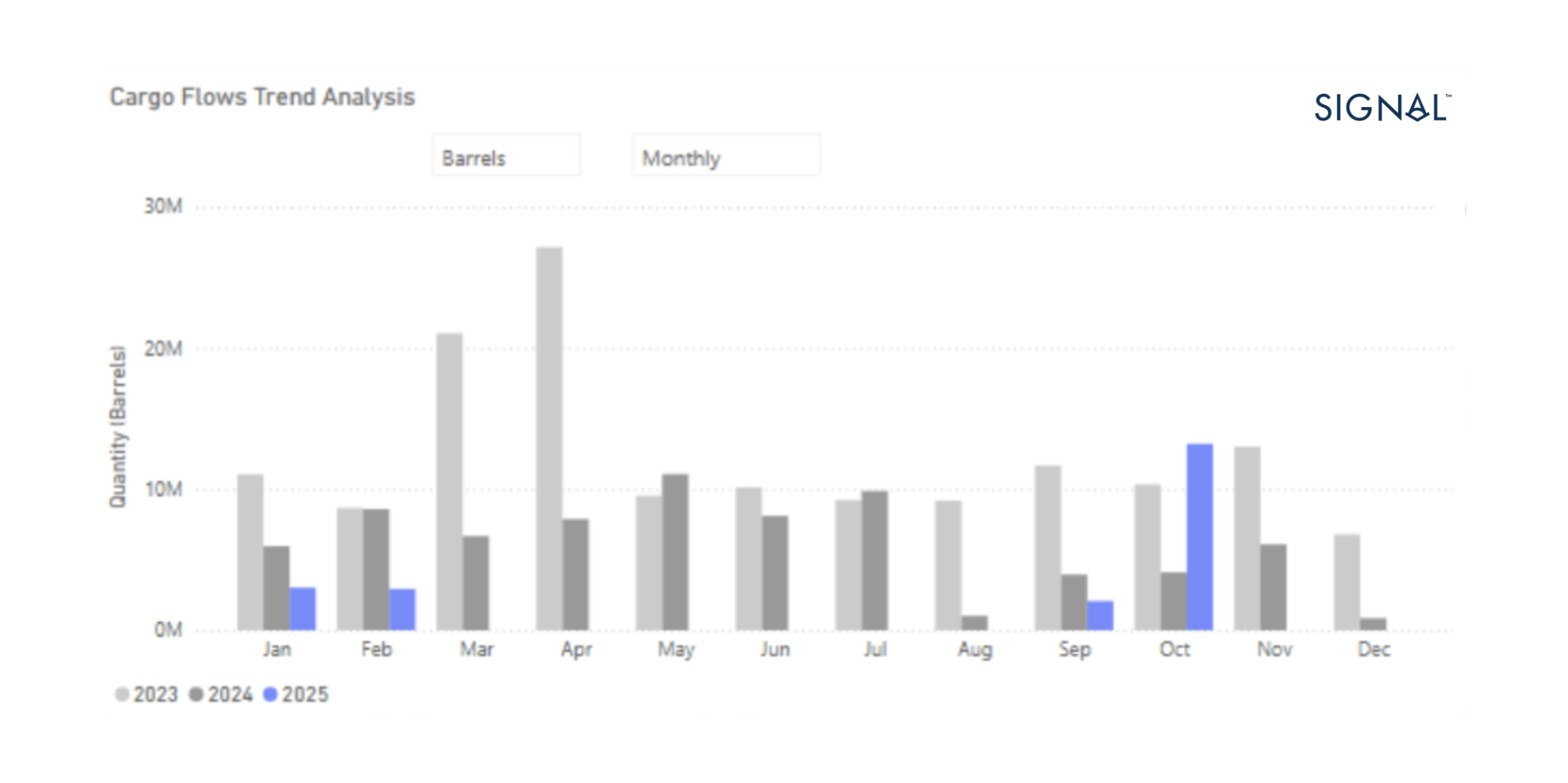

The data comparing Indian coal imports in 2023 and 2024 (image 2) highlights key shifts in supplier dominance and market shares. Indonesia has remained the largest coal exporter to India, increasing its share slightly from 43.0% in 2023 to 44.0% in 2024. This indicates India's continued reliance on Indonesian coal. However, Australia, the second-largest supplier, has seen a notable decline in its market share, dropping from 19.8% to 16.4%, suggesting diversification of import sources or a possible reduction in Australian coal competitiveness.

South Africa and the United States have slightly strengthened their presence in the Indian coal market. South Africa's share increased from 8.6% in 2023 to 10.7% in 2024, while the U.S. saw a marginal rise from 9.2% to 9.5%. These gains, however, come at the cost of a seemingly stable supplier—the Russian Federation, which has maintained its share at 9.3% across both years. Despite this apparent stability, Russia lost its position as the third-largest supplier in 2024, falling behind both South Africa and the United States. This suggests that while Russia’s overall volume might have remained the same, its relative importance in India’s coal imports has diminished due to higher growth in imports from other nations.

Meanwhile, Mozambique’s share slightly declined from 4.6% to 4.1%, indicating a small reduction in its coal exports to India. Canada, which contributed 1.3% in 2023, is absent from the 2024 data, while Colombia emerged as a new supplier with 0.8%. The United Arab Emirates (UAE) has seen a minor increase from 1.0% to 1.2%, reinforcing its small but consistent presence in the market.

Overall, while Indonesia remains the dominant player, India appears to be gradually adjusting its coal import sources, possibly due to economic, geopolitical, or trade-related factors. The relatively stable percentage of Russian coal imports, despite growth from other key suppliers, suggests that Russia is facing increased competition, leading to a decline in its relative ranking among India’s top coal suppliers.

India appears to be gradually adjusting its coal import sources in response to pricing, geopolitical pressures, and long-term commodity trading relationships. Indonesia remains the largest supplier, followed by Australia, South Africa, and the U.S. — all of whom rely heavily on vessel networks to maintain coal exports to India. This shift has also impacted maritime route planning and vessel allocation, with increased spot chartering activity observed on Southeast Asia–India corridors.

Crude Oil Dependence on Russia

India's crude oil imports from Russia have fluctuated due to sanctions, prompting Indian refiners to diversify sourcing. This shift affects not only geopolitical alliances but also commodity supply chains and maritime logistics, as oil flows increasingly originate from Middle Eastern and African ports. The reliance on large vessels, particularly Aframax and VLCCs, reflects India's strategic positioning in global energy commodity trading.

To maintain energy security and reduce dependence on Russia, state refiners are sourcing from the Middle East and Africa. Crudes like Abu Dhabi’s Murban and Nigeria’s Bonny Light are helping stabilise supply and shield India from crude oil price volatility. These actions are part of a long-term strategy shaped by both geopolitics and climate change imperatives.

Advancing Green Shipping

India’s green shipping initiatives are a direct response to global maritime decarbonisation goals. Investments in port electrification, cleaner vessels, and alternative fuels reflect the country’s vision of transforming its shipping industry into a more sustainable, low-emissions sector. As one of the largest importers of energy commodities, India's green shipping reforms are essential to reducing the overall carbon footprint of its maritime commodity flows.

The upcoming 250-billion-rupee maritime development fund will enable further investment in energy-efficient vessel technologies, reinforcing India’s position as a leader in clean maritime infrastructure. These investments are also expected to make Indian ports more attractive to global commodity trading companies looking for sustainable logistics partners.

These initiatives not only demonstrate India's commitment to sustainable maritime practices but also reflect its broader vision of reducing the environmental footprint of the shipping sector. As part of this push, India is also exploring the adoption of alternative fuels, energy-efficient vessel designs, and cutting-edge technologies to reduce emissions. The commitment to renewable energy in maritime transport positions India as a global leader in the movement toward more sustainable shipping practices and offers an important model for other nations seeking to address the environmental impact of their maritime industries.

Actions to reduce the carbon emissions footprint

India’s multi-pronged strategy to lower carbon emissions includes scaling renewable energy, promoting green hydrogen, and increasing energy efficiency across sectors. As the second-largest coal consumer globally, India faces global scrutiny, but its focus on coal India reforms and green alternatives demonstrates a commitment to cleaner growth.

India’s commitment to reducing carbon emissions is reflected in a comprehensive, multi-pronged approach aimed at both immediate and long-term sustainability goals. A cornerstone of this strategy is the accelerated expansion of renewable energy. The nation has set a bold target of achieving 500 GW of non-fossil fuel-based energy capacity by 2030, emphasising its intent to reduce dependency on coal and other fossil fuels. India has become a global leader in solar energy production and is also expanding its wind energy capacity, which is integral to the nation’s renewable energy mix. This transition to clean energy is essential not only for reducing emissions but also for ensuring a reliable, sustainable energy supply for the future.

The use of green hydrogen, electrification of transport, and emissions trading systems offer India a pathway to curb carbon emissions and tackle climate change at scale. These efforts are not just domestic, they also serve as India's strategic response to geopolitics and global cooperation under the Paris Agreement.

Energy efficiency also plays a central role in India’s efforts. Programs like the Perform, Achieve and Trade (PAT) scheme and the Bureau of Energy Efficiency’s Standards & Labelling initiative are designed to curb energy consumption in both the industrial and residential sectors. By reducing energy waste, these initiatives not only lower carbon emissions but also contribute to economic efficiency, fostering sustainable growth while conActions to Reduce the Carbon Emissions Footprint

India’s energy transition is tightly interwoven with its status as a top global commodity consumer. The country’s strategy to reduce coal dependence while scaling up renewables is shaping new dynamics in global commodity trading and long-haul vessel demand. The shift toward solar, wind, and green hydrogen not only affects energy sourcing but also transforms how energy commodities are produced, stored, and shipped via maritime networks.

The FAME scheme and electrification efforts will reduce fossil fuel imports and commodity price exposure, helping India weather crude oil price volatility. Simultaneously, India is exploring mechanisms like emissions trading and carbon pricing—tools that will further embed sustainability into the heart of commodity trading frameworks.

India’s push for Carbon Capture and Storage (CCS) technology, particularly in the steel and cement industries, further signals the evolving relationship between industrial production, commodity flows, and global maritime trade. Much of the cargo volume involved in these industries moves via bulk vessels, reinforcing the critical role of shipping in decarbonisation efforts.

Maritime Sector Decarbonisation and Innovation

India's initiatives to introduce LNG, methanol, and hydrogen as shipping fuels will redefine the vessel landscape and reduce emissions across key trade routes. The introduction of shore power at major Indian ports will allow vessels to plug into cleaner grid electricity while docked, slashing emissions and aligning with broader maritime sustainability targets.

These efforts are likely to gain attention from international commodity trading stakeholders seeking low-carbon transport solutions. As a result, India is poised to become a model for emerging markets integrating sustainability with maritime and energy policy.

Conclusion

India’s evolving energy strategy showcases a delicate balancing act between growth, sustainability, and security. As global climate change pressures rise and geopolitics continues to shape commodity access, India’s push for renewable energy, carbon emissions reductions, and reduced dependency on fossil fuel imports is timely and impactful.

By advancing coal India reforms, investing in green shipping, and preparing for long-term crude oil price volatility, India is building resilience in both its commodity trading frameworks and maritime logistics infrastructure. These shifts are reshaping vessel utilisation, supply routes, and trade relationships, positioning India as a forward-looking, adaptive player in the global energy landscape.

You can explore detailed trends in coal and oil flows to India from multiple origin countries annually, with in-depth insights on a weekly, monthly, and quarterly basis using the Signal Ocean Platform data. For more information, contact us at research@thesignalgroup.com.

Click here to get our weekly reports and special reports straight to your inbox.

Ready to get started and outrun your competition?

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.avif)

.avif)